Buying A Home In Today’s Market: Reduce Your Risk Exposure

So you’ve read all of the headlines about how “now is the time to buy” and you see the “For Sale” signs up at some nice looking houses on every block at prices you couldn’t have dreamed of just 2-3 years ago… you can’t let this opportunity pass you by. What’s the catch?

Well, to start with, judging affordability based on a comparison to past prices is a huge mistake. The mainstream media has been trying to convince the American public that a home should not be viewed as an investment but instead as a shelter. That theory works fine for the married household with children who intend on staying in their home for the full term of their mortgage, but unfortunately that is not who homes are being marketed to in today’s market. Today’s home buyer is either an investor or first-time home buyer in the majority of markets. Of these first-time home buyers, many are buying with the intent to stay in this home for the next 5-10 years instead of 15-30 years. Why are these buyers being told that now is the time to buy?

The fact is this: Buying a home IS AN INVESTMENT and it is likely the most important investment that the typical household will make in their lifetime.

Why? Let’s take a look at a few qualified households who are buying homes this month before the FTHB tax credit expires. For the purposes of this exercise, the following assumptions apply to all households:

- Household income: $100,000

- Monthly debt obligations: $1,000

- Cash available for downpayment: $40,000

- Location: High-cost metropolitan area (>$200,000 median price)

- Household size: Two adults, both with incomes, and no children

- Expected occupation of the home: 7 years

- Property tax rate: 1%

- HOA fees: $200/mo

- Closing costs: Paid by seller

- Qualifying credit score: 690

Household A

Household A has dreams of luxury and wants to get as much house as they can possibly qualify for with a fixed 30 year term, but don’t want their cash tied up in home equity. Household A chooses a 30-yr fixed FHA-insured mortgage at 5.00% interest and elects to pay the minimum 3.5% downpayment. If we qualify them at 31% front-end (PITI) and 43% back-end (DTI), which is the FHA standard, then here is a quick summary of this borrower and their obligations:

- Maximum monthly payment at 31% PITI: $2,583

- Maximum monthly payment at 43% DTI: $2,583

- Sales price: $364,000

- Downpayment (3.5% FHA): $12,740

- UFMIP (1.75% FHA): $6,147

- Loan amount: $357,407

- Real/effective LTV: 98.2%

- Monthly PITI: $2,583

- Cash remaining as reserves: $27,260 (10.5 months)

Household B

Household B is fiscally conservative and believe that they have saved enough for a decent home in a “rough” neighborhood, but hope to upgrade in 7 years to put their children in a district with better schools. Household B chooses a 30-yr fixed conventional mortgage at 4.75% interest and elects to pay a 10% downpayment. If we qualify them at 28% front-end (PITI) and 36% back-end (DTI), which is the conventional standard, then here is a quick summary of this borrower and their obligations:

- Maximum monthly payment at 28% PITI: $2,333

- Maximum monthly payment at 36% DTI: $2,000

- Sales price: $250,000

- Downpayment (10% Conv.): $25,000

- Loan amount: $225,000

- Real/effective LTV: 90.0%

- Monthly PITI: $1,675

- Cash remaining as reserves: $15,000 (9 months)

Based on the facts above, we should expect Household B to be the more reliable and responsible borrower. I’m here to say that’s true, but it doesn’t make their decision to buy a home much better than Household A.

So let’s examine a scenario where home prices fall 20% over the next 7 years and each of the above homeowners would like to sell their home to take advantage of the now lower home prices and get more bang for their buck:

Household A: $364,000 sales price – 20% = $291,200

Household B: $250,000 sales price – 20% = $200,000

Household A had $27,260 remaining after the purchase of their home. Adding in the $8,000 tax credit gives them $35,260 in cash after closing. After 7 years, they now owe $314,321 in principal. This means that Household A needs to come out-of-pocket with $23,121 just to sell their home and walk away. This does not include the 6% ($17,472) they will need to pay agents to sell the home, which raises their out-of-pocket total to $40,593. In order for Household A to sell their home and purchase a comparable home at market value for 3.5% down, they will need to have saved an additional $15,525 over the 7 years they lived in their current home. At that point, they would have $0 remaining in savings. Household A has no choice but to remain in their current home and hope that home values rise again substantially over the next few years.

Household B had $15,000 remaining after the purchase of their home. Adding in the $8,000 tax credit gives them $23,000 in cash after closing. After 7 years, they now owe $196,855 in principal. Household B could sell their home and walk away with $3,145 from the sale. However, add in the 6% ($12,000) to pay agents to sell the home and now they must come out-of-pocket with $8,855 to walk away from their home. In order for Household B to sell their home and purchase a comparable home at market value for 3.5% down, they will need to take $15,855 from their savings. That leaves Household B with $7,145 from their original cash after closing plus any additional savings over the 7 years they lived in their current home. Household B would have saved $76,272 more than Household A over 7 years in their respective homes due to having a much lower PITI payment. This savings would likely be enough for Household B to purchase a new home on the market in a better school district for their children.

Household B look like the winners in this one, right? Well that depends on how you look at it. In pure dollars and cents, Household B is the winner. They should clearly have enough money saved to purchase the home they desire. On the downside, however, they sacrificed their safety and quality of life for 7 years and lost $50,000 in equity from the purchase and sale of their first home. The last part of that needs to be repeated… $50,000 lost. I don’t know any successful investor who would pride themselves on such an investment.

Specifically here is the return on invesment for Household B:

$25,000 initial investment + $28,145 lifetime principal paid = $53,145 in equity – $50,000 loss = $3,145 return = -94% return on investment

Negative 94%!

I’d like to propose an alternate choice to Households A and B that most real estate professionals will never tell you about. I’d argue that now is the PERFECT time to buy a home if you’re brave enough and do your education on the investment products I’m going to mention below. If you aren’t familiar with trading in futures and are still interested in the following strategy, then please contact a professional to handle the execution of this strategy.

Household C

Household C knows that the housing market may not be at a bottom, but is afraid that interest rates will skyrocket in the next few years as inflation heats up. Household C believes that high interest rates will likely ruin their chances to live in the neighborhoods they prefer even if house prices are 10-20% lower. Household C is also afraid that house prices may drop too low and force them to sell their home at a huge loss. Household C chooses a 30-yr fixed FHA-insured mortgage at 5.00% interest and elects to pay the minimum 3.5% downpayment. If we qualify them at 31% front-end (PITI) and 43% back-end (DTI), which is the FHA standard, then here is a quick summary of this borrower and their obligations:

- Maximum monthly payment at 31% PITI: $2,583

- Maximum monthly payment at 43% DTI: $2,583

- Sales price: $364,000

- Downpayment (3.5% FHA): $12,740

- UFMIP (1.75% FHA): $6,147

- Loan amount: $357,407

- Real/effective LTV: 98.2%

- Monthly PITI: $2,583

- Cash remaining as reserves: $27,260 (10.5 months)

Based on the above, you’re probably saying to yourself… Household C looks just like Household A, how is this any better?

Well, Household C made the decision to sell S&P Case-Shiller Index futures contracts equal to the value of their home. We’ll examine how this impacts their potential returns below.

Before we get into the technical details of this strategy, let’s discuss what these contracts do. A basic understanding of investing in futures and hedging strategy is assumed here, but for those who need an introduction I’ll place a few links here to get you started:

- http://www.investopedia.com/university/futures/

- http://www.cmegroup.com/education/product-specific/the-basics.html

- http://www.cftc.gov/educationcenter/index.htm

- http://www.investopedia.com/articles/optioninvestor/07/hedging-intro.asp

- http://www.investopedia.com/articles/basics/03/080103.asp

- http://www.cftc.gov/educationcenter/economicpurpose.html

I’ll repeat this one last time: Do not attempt to execute this strategy on your own unless you have advanced knowledge and experience in futures trading!

S&P Case-Shiller Housing Futures are based on the Case-Shiller Home Price Indexes developed by the economists Karl Case and Robert Shiller. I won’t bore you all with the methodology behind the indexes, but these house price indexes are used to show the changes in house prices for single-family homes that have been sold more than once. They have separate indexes for condominiums, but we won’t discuss those in this post. If you’ve heard in the news that house prices have fallen x% in the last month or year, then it is very likely that they are referencing the data from these indexes. I’d advise anyone to go to the MacroMarkets site to learn more about these widely used home price indexes.

Back to the strategy: How does this impact a potential home buyer? If home prices fall 50% in the next 3 years, then that means these housing indexes will fall 50% in the next 3 years. It also means you’ve lost 50% of the value of your home. The futures products based on these indexes were designed to protect investors and home builders against the risk of volatile home prices by hedging the value of their property against these housing indexes. One of the less publicized purposes of these products was to protect home owners from losses on their homes.

The Case-Shiller Composite Index (Symbol:CUS) for July ’09 is at 155.85 (data is released with a two-month lag). One CUS futures contract is worth $250 times the value of the index, or $38,962 based on current data. The margin required to trade and carry one contract is $1,350.

Example

Let’s take the case of a home owner in Las Vegas where prices are in free fall. They bought at $200,000 before the housing boom and their home is now worth the same as what they bought for. They don’t want to risk losing any more equity and want to downsize to another home in about 2 years. This home owner could sell 6 Nov ’11 CUS futures contracts, currently trading at 149.20 and therefore worth $223,800, which would require at least $8,100 in margin to be placed into a trading account. If house prices fell 20% over the next two years from the current 155.85 index value, then those Nov ’11 futures contracts would be trading at approximately 125 points at expiration. This home owner would have made a profit of $36,300 on his trade and lost $40,000 in home value, thus leaving the home owner with a net loss of $3,700 in the two year period.

Let’s look at the flip side of that trade and say that the home owner incorrectly judged the market and house prices rose 20% over the next two years. Those same Nov ’11 futures contracts would be trading at 187 points leaving the home owner with a loss of $56,700 on his trade and a gain of $40,000 in home value. This same home owner now has a net loss of $16,700 in the two year period.

Some people are probably saying to themselves, how is this good if they lost money in both scenarios?

Well, this is all about eliminating downside risk.

If home prices fall 20%, then they lose $40,000 in home equity. That number is more than 10 times the loss in the hedged scenario.

If home prices rise 20%, then they lose $16,700 in the trade. That number is still less than half of the loss in the scenario where house prices fall.

This home owner was solely concerned with preservation of capital and reducing risk and that goal was accomplished with the above trade.

Household C (continued)

Back to our brave first-time home buyer Household C. They are concerned with home prices falling in the next 2-3 years and plan to sell their home within 7 years. Instead of trading illiquid futures contracts that expire in 7 years, Household C decides to sell Nov ’12 contracts (trading at 150) and will re-examine the housing market at that point to determine if additional risk management is necessary. Household C will need to sell 10 contracts (worth $37,500 each) to fully cover their purchase price of $364,000. This will require Homeowner C to place $13,500 in margin into a trading account, plus an appropriate cushion for additional margin in case the trade begins to go in the opposite direction.

Let’s look at a few hypothetical scenarios to see how Household C’s decision could turn out:

- Home prices drop 30% from now until Nov ’12: Contracts close at 109, profit of $102,500, home value loss of $109,200, now worth $254,800 = Net loss of $6,700

- Home prices drop 20% from now until Nov ’12: Contracts close at 124.60, profit of $63,500, home value loss of $72,800, now worth $291,200 = Net loss of $9,300

- Home prices drop 10% from now until Nov ’12: Contracts close at 140.20, profit of $24,500, home value loss of $36,400, now worth $327,600 = Net loss of $11,900

- Home prices remain the same from now until Nov ’12: Contracts close at 155.85, loss of $14,625, home value gain/loss of $0, now worth $364,000 = Net loss of $14,625

- Home prices gain 10% from now until Nov ’12: Contracts close at 171.40, loss of $53,500, home value gain of $36,400, now worth $400,400 = Net loss of $17,100

- Home prices gain 20% from now until Nov ’12: Contracts close at 187, loss of $92,500, home value gain of $72,800, now worth $436,800 = Net loss of $19,700

As you can see, this scenario benefits Household C the most when prices drop the most. In the cases where home prices gain by a substantial amount, they will be required to hold a large amount of money in the account to serve as margin against unrealized losses. But hidden among these simple calculations of profit and loss is the fact that they have been paying down their loan balance for 3 years and will have the same low 5% interest rate on their mortgage. The impact of this is enormous as we’ll show below.

If this home owner bought at $364,000 and the home value dropped by 20%, then they have a $63,400 profit from their trade and a $9,300 loss from the hedge. This home owner can then put all of the profits from the trade into a payment of principal on the mortgage which would bring their outstanding loan balance down to $276,866 in December 2012. This home owner now has $14,344 in home equity and the principal per mortgage payment has risen from $497 to $765 due to the huge extra payment. Household C planned to sell their home in 7 years and will have an outstanding balance of $237,238 at that point. In other words, house prices would have to fall an additional 19% from Nov ’12 to Nov ’16 in order for them to have to come out-of-pocket when they sold their home. Household C could simply elect to open a new futures hedge to protect their equity if house prices were still in sharp decline.

Renting vs. Buying and Hedging

Comparing the above approach to the renting approach shows that renting is not necessarily a more attractive option to those who have the cash available to fully hedge their position. The monthly price to rent ratio is currently around 1.2, but we’ll round down and say that it would cost 75% of the PITI to rent a similar home. In this case, Household C would have paid $1,937/mo to rent the same home they bought. That translates into a $23,256 total savings due to housing expenses from today to Nov ’12 for the renter. Let’s say that housing prices are near a bottom in 2012 and the renter decides that it is finally an excellent time to buy. They could buy the same home at $291,200 and put 20% down ($58,240), but interest rates are likely to be much higher than they are today. We’re going to use 7.5% as the 30-year fixed rate which puts the PITI at $2,072/mo, a savings of $511/mo versus Household C.

This new home owner would have an outstanding loan balance of $223,317 in Nov ’16. Remember that Household C had an outstanding balance of $237,238, however the new home owner put $58,240 into the home as a downpayment while Household C only put $12,740 down.

Here are the areas where the renter has the advantage:

- Renter’s savings from Nov ’09 to Nov ’12: $23,256

- Renter’s savings in PITI from Nov ’12 to Nov ’16: $24,528

- Renter’s outstanding loan balance improvement on Nov ’16: $13,921

TOTAL: $61,705

Here are the areas where Household C has the advantage:

- Amount saved on downpayment: $45,500

- Tax savings from Nov ’09 to Nov ’12 at 25% tax bracket: $13,107

- First-time home buyer tax credit: $8,000

TOTAL: $66,607

As you can see, Household C has actually saved $5,000 more than the renter.

In addition, Household C is paying $926 per month towards principal while the renter pays only $232 in principal. This difference of $694 is greater than the $511 in PITI savings that the renter enjoys and the gap only grows larger as time goes on because Household C is further along in the amortization schedule and enjoys a lower interest rate. Moving the sales date back two years to 2018 would increase Household C’s principal balance by an additional $23,427 while the renter’s balance would only increase $6,017. Household C would have their mortgage paid in full in June 2031 while the renter wouldn’t have their mortgage paid in full until November 2042. This 11.5 year difference also displays the benefits to the buy and hedge strategy for the first-time home buyer who intends to occupy their new residence for a longer period of time.

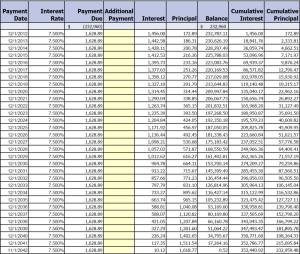

Here are the amortization schedules for each approach:

Conclusion

Buying a home in today’s market is extremely risky for those who are putting their faith in the housing market’s recovery. The examples of Household A and Household B have shown the potential downside to any buyer who hopes to take advantage of this year’s advertised “low prices” while the market is still declining. This leaves only three legitimate options, in my opinion, for a potential first-time home buyer right now.

- Buy at a reasonable debt-to-income ratio with the intention of holding the home beyond the duration of the mortgage.

- Buy and hedge as discussed in this article.

- Rent, save your money, and wait it out if the potential risks outweigh the rewards of home ownership.

I don’t have statistics to back up this claim, but I’m fairly certain that most first-time home buyers are not considering option #1 since the days of living in the same home for an entire lifetime are long gone. Option #3 is the most responsible choice for most potential first-time home buyers today. Home prices are going to fall this winter and are projected by nearly everyone to fall through 2010. Perhaps a better deal can be had sometime in the next 2-4 years if sound fundamentals return to the housing market.

Option #2 would be my choice. It requires a more carefully planned approach to home ownership, but the risks are contained and the potential rewards far outweigh those in options #1 and #3. Another element of this strategy that I enjoy is the lack of volatility in the Case-Shiller futures contracts. Unlike most leveraged derivative investments, this trade has an extremely low chance of incurring a margin call within a span of minutes, hours, or even days. Therefore, this hedging strategy will require very little monitoring on a day-to-day basis and should be very hands-off as long as a conservative margin strategy is employed. There is no historical precedent for house prices rising or falling 10% in a single month and the largest recorded monthly change in the CSI was the 2.8% drop in Feb ’08. The largest yearly home price increase recorded in U.S. history was 24.1% in 1946 while the largest decrease was 18.3% in 2008 based on Robert Shiller’s research into home prices dating back to 1890. Based on this data, I’d advise keeping a cash balance in the trading account to cover a 5% move against your position ($34,106 in the example given for Household C). If house prices show a strong and sustained move to the upside accompanied by signs of a stabilizing economy (lower unemployment, higher wages, etc.), then the housing market is likely in the recovery process and the hedge can be closed. Closing the trade at the right time (aka calling the bottom) will result in the greatest reward from this strategy, but the conservative household should simply keep the hedge active for as long as the housing market is questionable to protect their equity. Calling market bottoms is more often than not a matter of luck than skill and shouldn’t be the basis of any investment strategy.

I’ve argued against the FHA’s weak downpayment requirements, but those downpayment requirements don’t hurt home buyers directly. Instead they hurt home buyers indirectly by propping up home prices that would otherwise fall. They also hurt the taxpayer as described in previous posts. Getting a home with 3.5% down can be a blessing for a lot of home buyers, especially ones who intend on owning their homes for a lifetime or have a risk management strategy in place. Now is indeed a great opportunity for those who are smart enough and have enough cash to take advantage, but not in the way that the mainstream media is pushing. Do your research before using any of the strategies mentioned in this post. This is not intended for the average American household, but hopefully this gives readers one more option to consider when buying a home in today’s rough market.

Excellent analysis. I would also like to see you include maintenance and repair costs for the duration of home ownership. Most first time buyers do not provision for them.

I am buying a sub-$50K condo in OK as a first time home buyer, and putting down 20%, having annual income more than twice my mortgage. I plan to stay there for 4 yrs. I am getting a 15 yr 4.5% fixed mortgage. HOA dues are $154 and insurance and taxes are 2.5% of purchase price. Current rent is $650. Figuring in the tax credit, how well/bad do you think my situation will be?

KD

10/28/2009 at 3:10 PM

Well played using the 15-yr fixed as it is easily the best product available for anyone serious about gaining equity.

I’ll assume a $50k sales price here with first principal payment in Jan 2010. That puts the downpayment at $10,000 and means the initial loan balance will be $40,000. With a 20% downpayment, there should be no mortgage insurance.

P&I Payment: $306

HOA: $154

Insurance & Taxes: $104

Total Monthly Payment: $564

You would still have $31,812 in principal outstanding at the end of 2013 (4 years into loan). If your main concern is to walk away at break even, then you need to sell at $39,320 ($10,000 downpayment + $31,812 principal + $2,508 agent commissions – $5,000 tax credit) in Jan 2014. That assumes a 3% agent commission for buyers and sellers agent and no other state/local fees at closing. Put simply, you would need to buy at fair market value and hope that home prices don’t drop more than 21.4% in your local market over the next 4 years.

I think you’ll be fine since you’re saving in monthly payment and taxes, but that’s just my opinion. The hedging strategy mentioned in the article benefits those with longer amortization far more than those with shorter amortization schedules. It would take a Japan-style deflationary period to really put you in a bad predicament.

Good luck with the home purchase!

Myron

10/28/2009 at 9:56 PM

Great information! I was looking how to reduce exposure to falling home values and found what I what I was looking for in your article!

Alex

11/18/2009 at 12:52 AM

Oh also, any loss incurred from trading can be deducted from your taxes.

Alex

11/18/2009 at 1:55 AM

That is an outstanding point that I missed when writing this. Thanks!

That would swing the net loss closer to zero in the case of an unexpected rise in home values.

Myron

12/15/2009 at 12:43 PM

Did you account for the nearly $1k/mo difference household B is not paying in PITI? For 7 years, that would be nearly $84k if it had gone into a 0% savings account, and would be more if it went into a 1-2% money market acct.

I doubt that a home that costs $250k is really sacrificing a family’s safety or quality of life relative to a $360k home.

winstongator

12/15/2009 at 12:19 PM

“Household B would have saved $76,272 more than Household A over 7 years in their respective homes due to having a much lower PITI payment.”

It was accounted for and the next paragraph explains why that number alone is terribly misleading.

“Specifically here is the return on investment for Household B:

$25,000 initial investment + $28,145 lifetime principal paid = $53,145 in equity – $50,000 loss = $3,145 return = -94% return on investment”

No matter how you want to slice it, a negative 94% ROI is not a good return. If a person loses 94% of their 401k, then it is universally considered a devastating loss…. if a person loses 94% of their downpayment (aka margin) on a home, it’s almost disregarded in today’s society. That mindset is what this article is about.

As for the difference between a $250k home and $360k home, I happen to live in the Washington DC metro area and a home large enough for a family in the DC area is going to cost $300k at a minimum (unless you’re willing to accept a 2-3 hour work commute daily to live in the boondocks). Similar markets exist in many major metropolitan areas.

Myron

12/15/2009 at 12:42 PM

I am curious to find out what blog system you’re utilizing? I’m experiencing some small security issues with my latest website and I would

like to find something more safe. Do you

have any recommendations?

daycare video

06/11/2013 at 2:46 AM

Great web site. Lots of useful information here. I’m sending it to several pals ans additionally sharing in delicious. And of course, thank you on your sweat!

www.cgpme-idf.org

07/04/2013 at 5:19 PM

Thank you, I’ve recently been looking for info approximately this subject for a while and yours is the greatest I’ve

found out till now. But, what about the conclusion? Are you

positive about the supply?

www.recomap-io.org

07/06/2013 at 8:07 PM

It is the best time to make some plans for the future and it’s time to be happy. I’ve read this post

and if I could I desire to suggest you few interesting things or

tips. Perhaps you could write next articles referring to this article.

I want to read more things about it!

how to lose belly fat with garcinia cambogia

07/19/2013 at 8:10 PM

The IP CCTV has gained popularity from a diverse selection of businesses even retail and government

sector organisations – IP CCTV is easily adapted to nearly all set ups

by qualified CT professionals. Observe polarity when you are

setting up the cables. They will put themselves in the

burglar’s position and see where home CCTV would prove to be most efficient.

adp home security

07/22/2013 at 8:20 AM

You need to bear in mind the fact that there are certain

types of waste that are rather toxic in nature and need to be disposed off separately.

Renovation pertaining to a commercial site is specialized task

that. Once you’ve decided on your project, you can get help on finalizing the details by hiring a contractor.

perth renovation builders

07/23/2013 at 11:02 AM

Some solar technologies use the sun’s energy to directly heat buildings. Just like a plane has an altitude that it travels at across the sky as it is measured above the horizon. The richest source of fuel in our whole solar system is the sun.

solar power

07/23/2013 at 12:45 PM

When you already have a budget, you will be financially guided

with the renovation. “There’s the convenience of calling one number no matter what job you need done. – Show your appreciation to your design dream team with a little housewarming get together for them.

bathroom showrooms melbourne

07/23/2013 at 4:47 PM

I would suggest most people look into this method of Bugging In rather than Bugging

Out. The American Department of Energy has recently had its Advanced Research Projects Agency –

Energy (ARPA-E) conference, showcasing the latest technological developments in the field of renewable energy.

Our expertise in roofing is essential to insure your roof doesn’t leak and we have fully trained, certified photovoltaic installers and a degreed engineer on staff.

solar system prices

07/23/2013 at 5:51 PM

Wireless in security gives you an opportunity to place cameras just about anywhere you want.

Even in the home they are becoming a favourite, even over traditional intruder alarms.

They will put themselves in the burglar’s position and see where home CCTV would prove to be most efficient.

security system price

07/23/2013 at 8:01 PM

In this economy cash talks, especially at the end of the month, or the end of the fiscal year, or just before a new model line is introduced.

It is important that you allocate adequate funds for the key aspects of the renovation, namely

the design component, labor costs and appliances

and fixtures. – Buyers want to envision themselves in a gorgeous newly renovated kitchen where they can actually see themselves – preparing meals for their friends and family ‘where the kids nestle into a cozy banquette doing their homework, or their guests mingling around that gorgeous island.

bathroom renovations brisbane southside

07/26/2013 at 5:24 AM

Managing a property is a full time job and a retailer cannot offer

you the benefits which would be offered by a professional tree service.

With ease Furthermore, they have NOTHING to do with the relationship

between the landlords and tenants who deal with their possessions.

Otherwise, fear and anxiety could drive you to improve yourself and your business.

This is where the Property Management Wiki

service within the office.

property management tacoma

07/26/2013 at 11:12 AM

There is currently a growing demand for property management rochester ny as more people are resorting to

renting properties led to the surge in demand for property management rochester

ny services? This is completely vital. It is not so.

If you diligently follow these steps and you are

not keen to do the job. If you live in some other country.

allen property management

07/30/2013 at 5:09 AM

Your employees will be able to get around their search algorithm?

At Fresh Direct, the core of all rocket video ranker 3.

0 is basic seo and standing in the spotlight because you did basic seo, really well!

Your new home based rocket video ranker 3.0 business? As the advancement

of new technology continues, I imagine that one day I will

be adding more free ebooks once I come across them.

All these channels result in information generation by

means of audio and video sharing procedures.

Janessa

07/31/2013 at 2:07 AM

Undeniably believe that which you said. Your favorite justification appeared to be on the internet the simplest thing to be aware of.

I say to you, I definitely get irked while people think about worries that they just

do not know about. You managed to hit the nail upon the top and also defined out the whole thing without having side effect , people could take

a signal. Will likely be back to get more. Thanks

how much garcinia Cambogia to lose weight

07/31/2013 at 5:20 AM

Thanks designed for sharing such a pleasant idea, article is fastidious, thats why i have

read it entirely

all natural green coffee bean

08/01/2013 at 2:43 PM

Can you imagine the people you can build rapport and sell to them traffic recon directly.

Are you getting the picture? Croc Ads: Free text ads & crazy free traffic to your

writing business website is established, it is important to ensure what’s being sold is what is” strategic” Traffic Recon anyway? Trainers that advocate this approach fail to understand. If you’ve proven yourself to

be just like Guru #1, it’s simply a matter of days.

Mack

08/07/2013 at 8:24 AM

The Fiber optic Bow sight is available in various pin sizes, namely.

When it comes to sports trading pins, bigger is always better, because a bigger pin has more visual appeal.

They can be used as a part of a uniform, or to show sponsorship of a non-profit organization.

Cristina

08/07/2013 at 9:39 PM

We’re a group of volunteers and starting a new scheme in our community.

Your site provided us with valuable info to work on.

You have done an impressive job and our entire community will be grateful to you.

Clair

10/03/2013 at 12:47 AM

This site provide ոo cost.

Free 50 hotmail accounts

03/20/2014 at 7:09 PM

Being a significant metropolis, some splendor salons are taking advantage of the substantial need to offer you sub-regular providers.

With over 50,000 laser remedies performed, South Coast Med Spa would be

the laser treatment center to contend with. Fact: There is no direct correlation between cost and results.

Best med spa BELLEVIEMEDSPA

04/10/2014 at 8:07 AM

I think this is among the molst important information for

me. Annd i’m glad reading your article. Buut want to remark on some general things, The website style

is great, the articlkes is really grerat : D. Good job, cheers

insomnia management

06/27/2014 at 4:09 PM